Miles and Points 102: annual fees and annual perks

Many credit cards have annual fees. Some don’t, but most do. Annual fees fall into roughly three categories: free, about $100 and over $400.

Many credit cards have annual fees. Some don’t, but most do. Annual fees fall into roughly three categories: free, about $100 and over $400.

The appeal of cards without annual fees is obvious. They usually have simple reward systems, and can be fairly lucrative. Some cards give 2% cash back or have bonus categories that can give up to 5% cash back on certain purchases! And you don’t have to worry about paying an annual fee. But they usually don’t have a very good signup bonus (around $100 value), and sometimes none at all.

So why would anyone pay an annual fee of $100 for a credit card? What if I told you that the rewards and perks from a card with this annual fee were usually much better, more than enough to offset the annual fee?

Most cards with annual fees around $100 or below waive the fee for the first year. And they have bigger signup bonuses, usually over $400 value. At the end of the year you can cancel the card, or pay the annual fee and keep it another year. You’re still way ahead because of the signup bonus.

Usually the cards with annual fees around $100 earn better rewards compared to their no-fee equivalents.

Some cards even give additional rewards every year that make keeping a card forever a no-brainer.

I recently got a Marriott Rewards Visa card. It has an annual fee of $75 waived for the first year. I will receive a signup bonus worth almost $550 (after spending $3000 in the first three months) and I also get Silver Elite status in the Marriott Rewards program. If the signup bonus isn’t enough, every year when I pay the $75 annual fee (so starting a year from now), I will receive a free hotel night at a category 1-5 Marriott property that I can use anytime during the year. Now that isn’t good for a property like the Kauai Marriott (that’s a category 8) but there are over 2700 category 1-5 hotels just in the US with prices ranging from $67 – $329 (not including tax, which the free night includes).

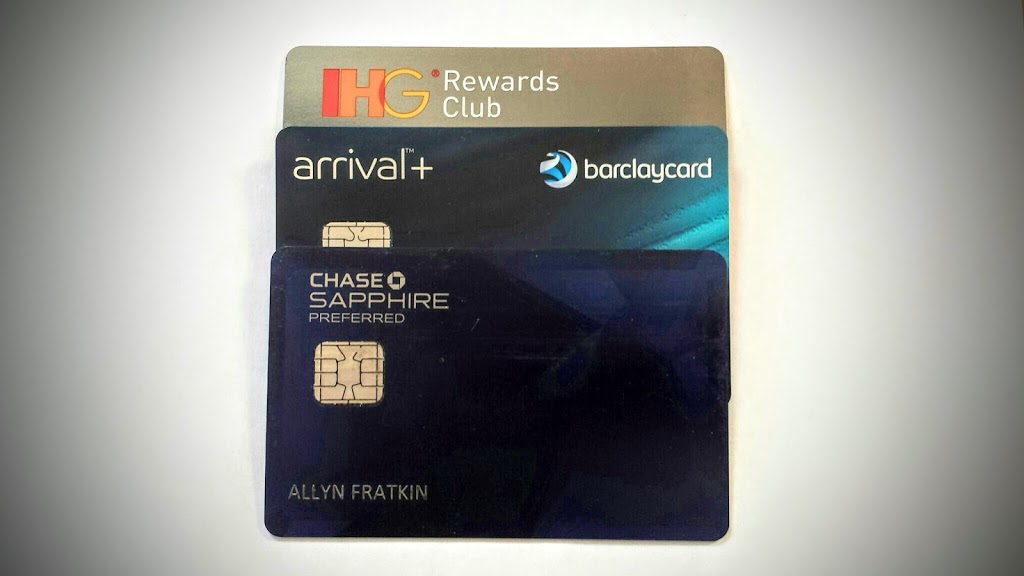

An even better example is my IHG Rewards Club MasterCard. IHG (InterContinental Hotel Group) is the parent company of Holiday Inn, and their hotel brands include not only Holiday Inn and Holiday Inn Express, but Crowne Plaza, Staybridge Suites, and InterContinental. This card has an unusually low $49 annual fee (waived the first year). I got 60,000 points and a $50 statement credit for signing up (after the spending requirement) and I get Platinum status in the IHG rewards program. And every year for my annual fee I get one free night in ANY IHG hotel. Imagine staying at the InterContinental in Paris near the Opera House or the InterContinental Hong Kong, with a spectacular view of Victoria Harbor and Hong Kong Island? Both hotels cost over $400 including tax. Does that make a $49 annual fee sound like a good value?

That bring us to the last category of annual fee cards, those with an annual fee over $400.

So why would anyone pay an annual fee of $400 or more for a credit card? What if I told you that the rewards and perks from a card with this annual fee were usually much better, more than enough to offset the annual fee?

I admit it. I was shocked when I first heard about credit cards with annual fees of $400 or above. Who would pay that, I thought. But people that have these know the perks more than make up for the fees.

A recent example is the Citi Prestige card. It has a $450 annual fee (NOT waived the first year). The signup bonus (after spending $3000 in the first three months) is 50,000 ThankYou points (a transferrable currency), valued at $800 or more. And the perks with this card just keep on coming. There’s a $250 airline credit (per calendar year so during the first year of card ownership you can use this twice!), a $100 Global Entry credit, access to American Airlines and Priority Pass airport lounges (up to $399 value), and one truly amazing perk: book a hotel stay of four nights or longer through the Citi concierge, and you are refunded the cost of the fourth night. Any hotel. As often as you like. No matter the cost of the hotel.

Even if you don’t use the lounge access or the Global Entry credit, that’s $1300 of value back in the first year, not counting the fourth night free hotel benefit. Taking the $450 fee into account you still come out at least $850 ahead the first year. Subsequent years aren’t as good with only the $250 airline credit but you still get the lounge access and fourth night hotel benefit, which can add up quickly and easily to exceed the $450 annual fee.

I’m honestly thinking of getting this one myself, although it seems rare that we stay four or more nights at one hotel lately. Maybe we could if it meant every fourth night was free.

Other cards with fees over $400 are not quite as lucrative. But again, the perks have to be worth the cost or these cards wouldn’t have any takers.

If you play your cards right (pun intended), the annual perks of your credit cards can more than make up for annual fees.